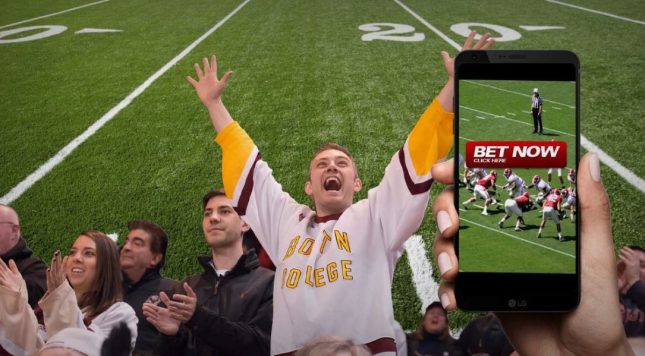

NBA and MLB return will put sports betting apps in winning position

The impact of COVID-19 on the growth of the legal sports betting market is expected to be “serious but temporary”. As NBA, MLB and NHL work on the reopening, co-founder of US-based DraftKings and its CEO Jason Robins explains how sports fans react it its world return, even if they are not allowed in the stands.

US sports betting providers such as DraftKings expect demand to increase next month when the major leagues start playing again during the coronavirus pandemic.

KICKING OFF THE NEW SPORTING CALENDAR

Months of investment and rapid growth to fuel the US sports betting markets online came to an abrupt halt in March when the MLB and NBA along with other major sports leagues around the world were forced to suspend their season due to public health risks. With casinos across the country closed and games of chance unavailable, sports betting activity in the United States, Canada, Europe, Australia and New Zealand has declined.

For many Kiwi fans that, observe a lot of US sport, it was able to find some reprieve with virtual sports betting known as eSports that took place on New Zealand sites found in the top 10 lists of sites like https://www.onlinecasinonewzealand.nz/, which combine sportsbook with casinos online, cause both of these activities are bonded with gambling.

With the reopening of casinos, the growing number of sports betting and online betting applications will benefit from pent-up demand and from customers, who have become increasingly dependent on digital platforms during this life-changing pandemic.

The expected return of NBA and MLB games in late July will allow traders to offset some of their recent financial losses in a tough market, with DraftKings being a precursor to market capitalization.

As of this month, seven states, Nevada, New Jersey, Pennsylvania, Rhode Island, West Virginia, Indiana and Iowa, have completed legal online sports betting. DraftKings are leaders in the emerging market for legal online gaming.

DODGERS AND THE YANKEES ARE WORLD SERIES BETTING FAVORITES

All of the money invested into New Jersey-based sites, fell 65% to $ 181.9 million in March, the month when the sports championships were forced to end the game. It continued in April, when membership dropped 82% year over year to $ 54.6 million and almost all sporting events were on hold.

The market showed signs of recovery in May when the UFC, golf, NASCAR, and other sports returned to play with strict security. New Jersey’s share last month was $ 117.8 million year-over-year, but it was a significant improvement.

MLB COMES JULY, PLAYERS TAKE HEALTH AND SAFETY PLAN

The impact of COVID-19 on the growth of the legal sports betting market is expected to be “serious but temporary,” said Canaccord Genuity analyst Michael Graham in a recent investor statement. Financial difficulties and budget deficits can lead some states to approve sports betting faster than expected.

“We believe that the COVID-19 pandemic can serve as a catalyst to accelerate the legislative process aimed at legalizing sports betting and increasing tax revenues,” added Graham.

DraftKings shares have risen since the company opened public talks in April. Another online potential player is a business called Barstool Sports, who are expected to launch their own sports betting app come this fall, with lead investor Penn National Gaming, who are the largest retail casino operator in the United States.

Players in New Zealand, will be unable to access these operators, but have a healthy choice in companies such as Spin Casino, Leo Vegas, and 888 Sports Casino.

The recent increase in the volume of sports betting, which is normally considered a niche attraction, such as international football games, golf tournaments and NASCAR, has fuelled optimism about the short-term legal prospects for the market. For example, the operator LeoVegas recorded 3,982% climb the number of bets on the RBC Heritage PGA Tour tournament last week compared to the same event last year.

According to Chris Grove, analyst at Eilers and Krejcik, a stable research and advisory company with the return of betting activity peaks on lesser-known events during a sport slowdown are not a good indicator of overall demand The NBA and MLB become many traders it is difficult to compensate for the recent short term losses.

“I think you will see an accumulated question if and when great sports comes back,” said Grove. “But it is likely to be a temporary increase which is unlikely to fully compensate for the demand lost in recent months.”